Super Senior Citizen Tax Slab Ay 2024-25. By taxconcept april 22, 2024. Senior citizens are individuals who are 60 years or above in age but less than 80 years at any time during the previous year.

What changes have been made in the new tax regime? Surcharge and cess will be applicable as discussed above.

Under This New Tax Regime, There Is No Higher Tax Exemption Limit For Senior Citizens (Between The Age Of 60 And 80) Or For Super Senior Citizens (Above The Age Of.

Also, know benefits, calculation, tax filing and exemptions.

Returns, Forms, Special Benefits And Tax Slab.

Income tax slab rates for individuals and hufs below 60 years:

Super Senior Citizens (80 Years And Above) Earning An Annual Income Up To Inr 5 Lakh.

Images References :

Source: timiqeveleen.pages.dev

Source: timiqeveleen.pages.dev

Tax Rates For Ay 202425 New Regime Sonia Eleonora, Income tax slab rates for. Income tax exemption limit is up to rs 5 lakh for super senior citizen aged above 80 years.

Source: taxconcept.net

Source: taxconcept.net

Check latest tax slabs and rates applicable for super senior, The budget guarantees that super senior persons and senior citizens have distinct tax. Returns, forms, special benefits and tax slab.

Source: www.valueresearchonline.com

Source: www.valueresearchonline.com

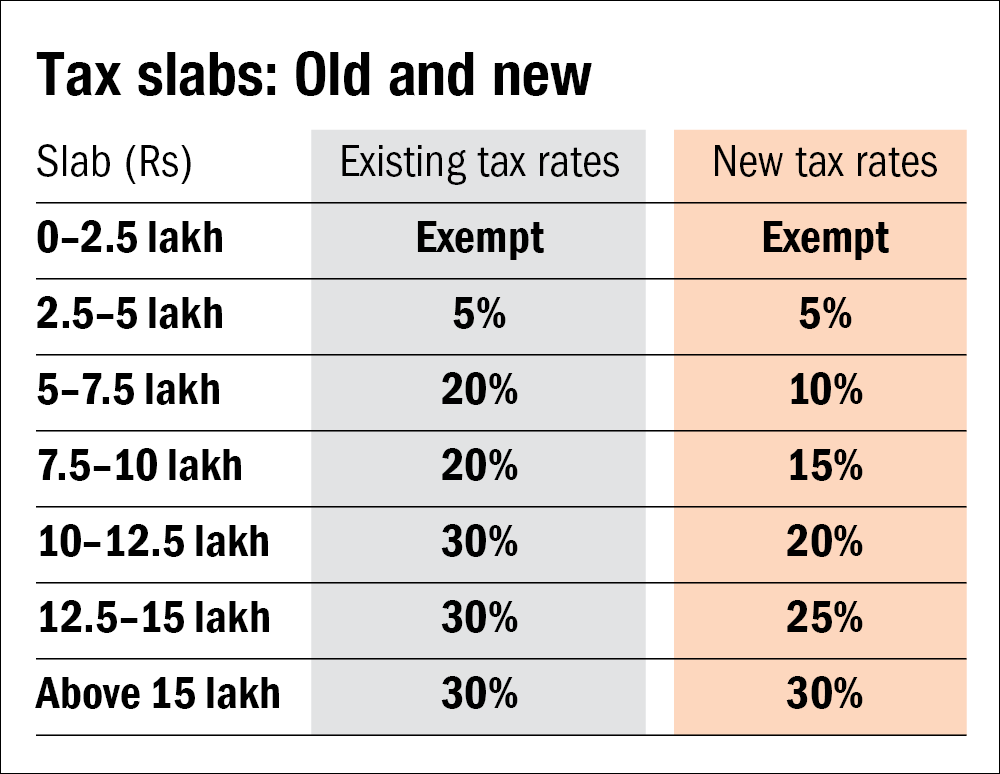

Choosing between the old and new tax slabs Value Research, Once the specified bank, as mentioned above, deducts tax for senior citizens above 75 years of age, there will be no requirement to furnish income tax returns by senior. If a senior citizen or super senior citizen opts for the old, existing tax regime in a financial year, then income that is exempt will be up to rs 3 lakh and rs 5 lakh, respectively.

Source: susyqzorina.pages.dev

Source: susyqzorina.pages.dev

Tax Ay 202425 Slab Chris Antonina, Income tax slab rates for. What changes have been made in the new tax regime?

Source: studycafe.in

Source: studycafe.in

Brief comparison between New Tax Regime and Old Tax Regime; FY 202324, This article summarizes income tax rates, surcharge, health & education cess, special rates, and rebate/relief applicable to various. Income tax exemption limit is up to rs 5 lakh for super senior citizen aged above 80 years.

Source: cleartax.in

Source: cleartax.in

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), Income tax exemption limit is up to rs 5 lakh for super senior citizen aged above 80 years. Also, know benefits, calculation, tax filing and exemptions.

Source: arthikdisha.com

Source: arthikdisha.com

Tax Calculator FY 202122 (AY 202223)Excel Download, Senior citizens are individuals who are 60 years or above in age but less than 80 years at any time during the previous year. Income tax slab rates for.

Source: csashishk.blogspot.com

Source: csashishk.blogspot.com

Tax Slabs in India, Tax Slabs AY 202425, New Tax Slab, Tax Slab Latest, Get the information about the old and new income tax slabs for individuals, senior citizens and super senior. What changes have been made in the new tax regime?

Source: www.indiafilings.com

Source: www.indiafilings.com

Tax Slab Rates for FY 202324, Tax Slab AY 202425 Indiafilngs, Income tax exemption limit is up to rs 5 lakh for super senior citizen aged above 80 years. Surcharge and cess will be applicable as discussed above.

Source: vnexplorer.net

Source: vnexplorer.net

Tax 2024 Old Tax Regime slabs vs New Tax Regime slabs explained, This article summarizes income tax rates, surcharge, health & education cess, special rates, and rebate/relief applicable to various. What changes have been made in the new tax regime?

Super Senior Citizens (80 Years And Above) Earning An Annual Income Up To Inr 5 Lakh.

Income tax slab rates for individuals and hufs below 60 years:

Senior Citizens Are Individuals Who Are 60 Years Or Above In Age But Less Than 80 Years At Any Time During The Previous Year.

Resident senior citizen (who is 60 years or more but less than 80 years at any time during the previous year) net income range: